Stop loss orders not only help traders minimize losses, but they also weed out the weakest stocks. In previous posts I outlined trades of oversold / mean-reversion opportunities I saw in the market. Most of them have turned out profitable while I was stopped out of a few positions with small losses. Now, I am managing those winning positions to protect the profits. First, I always have a 3.5 x ATR based trailing stop as headline protection. And second, I look at the price charts to see if it makes any sense to partially sell out of a position or buy more into a position.

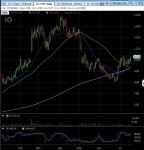

I am currently accumulating in pullbacks for ACI, BTU and IO and I progressively sold out of WYNN and INTC and closed them out today.

Here are the charts:

- IO

- BTU

- ACI

- INTC

- WYNN