Writing my observations on the way I trade a given setup helps me improve the way I execute it. I want to share with you what I learned from a failed trade in ASIA.

I bought ASIA shares on 12/2/09 as it began to break out of a tight trading range. The next day, Thursday, it sold off pretty hard and got stopped out as the price action drove a few cents down from my stop. To make it more painful, it moved higher the following Monday and I missed it.

Looking at the chart I realized two things:

- My stop was above support.

- My risk vs. reward would be better if I bought closer to the lower end of the range.

- I was afraid I would miss the trade when I entered.

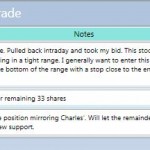

Learning from my mistake I traded MFW differently. I bought closer to the support of its trading range with a tighter stop just below. Like ASIA, MFW took off last Friday and followed through to the upside today. I sold off 1/3 of my position and adjusted my stop a bit higher with the intention to give the remaining shares some room to run up.

Even failed trades give you valuable lessons if you document them.