I continue to have success playing break outs on a handful of stocks. I want to share with you what I learned from trading VISN and how I traded SNIC this week.

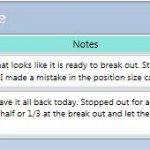

I traded the breakout in VISN last week with sub par results. VISN had a very bullish daily chart pattern and I entered my position right at the base according to plan. (See previous post here.) The stock broke out on Dec. 15th (see chart below,) but the next couple of days gave back all the gains. I was stopped out for a small profit on Dec. 16th and I realized that I should have sold a portion of my position as the break out developed. And that is exactly how I traded SNIC.

Again, I bought SNIC near the base of the consolidation area and waited patiently for it to break out. The stock took off on Dec. 17th and reached my primary target that trigger a sale of half of the position. At the end of the day I adjusted my stop to 10.49 (I always put my stops a penny or two below multiples of 5.) On Dec. 18th the stock reached my second target right at the open and I sold another 1/4 of the initial position (half of the remaining shares.) I still have the remaining 1/4 of the original position and will let the market take me out this time. I am using now Vervoort’s modified ATR stop system.

I have began to twitter my entries and exits in real-time (or as fast as I can during market hours.) Follow me @StockTradeJrnl.

My journal entries and charts are below.