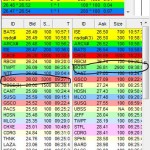

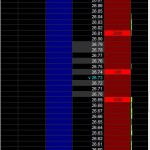

I have been paying attention to the Level 2 data and factoring it in my decisions whether to enter a trade or exit. I began to really be aware of it after a few failed breakout trades that had been working like clock work recently. I first noticed large orders looming on a trade I placed on January 8th for FIRE. My entry was favorable as I bought at the bottom of the consolidation range and was playing a break out or at least an attempt. The next day FIRE gaped to 27.50 and was met with the large sell order and quickly retraced to 27 where I closed for a small profit. There was no way the stock would move higher with such large order waiting above. In fact, because that order was in place, smaller sellers were forced to sell below. Today it is trading back at 26.5 where it has found some footing, but these orders remain in place. I wonder if they will disappear after Options Expiration Friday?

Looking at a chart is one thing, but it won’t show you orders that haven’t been filled. Record your observations on your journal and review them periodically. Use this information to fine tune your trade plan and strategy.

Pingback: Don’t Panic! « Stocktradejournal's Blog